An adjustable-rate mortgage (ARM) is a mortgage loan with the interest rate on the note periodically adjusted based on an index that reflects the cost to the lender of borrowing on the credit markets. The loan may be offered at the lender’s standard variable rate/base rate. There may be a direct and legally defined link to the underlying index, but where the lender offers no specific link to the underlying market or index, the rate can be changed at the lender’s discretion. The term “variable-rate mortgage” is most common outside the United States, whilst “adjustable-rate mortgage” is most common in the United States and implies a mortgage regulated by the Federal government, with caps on charges. In many countries, adjustable-rate mortgages are the norm, and in such places, may simply be referred to as mortgages. (“Adjustable-rate mortgage,” n.d.)

“A 5/1 adjustable-rate mortgage has an average rate of 5.03%, an uptick of 13 basis points from seven days ago. For the first five years, you’ll typically get a lower interest rate with a 5/1 ARM compared to a 30-year fixed mortgage. However, you may end up paying more after that time, depending on the terms of your loan and how the rate adjusts with the market rate. If you plan to sell or refinance your house before the rate changes, an ARM may make sense for you. If not, shifts in the market may significantly increase your interest rate.” Justin Jaffe, cnet.com

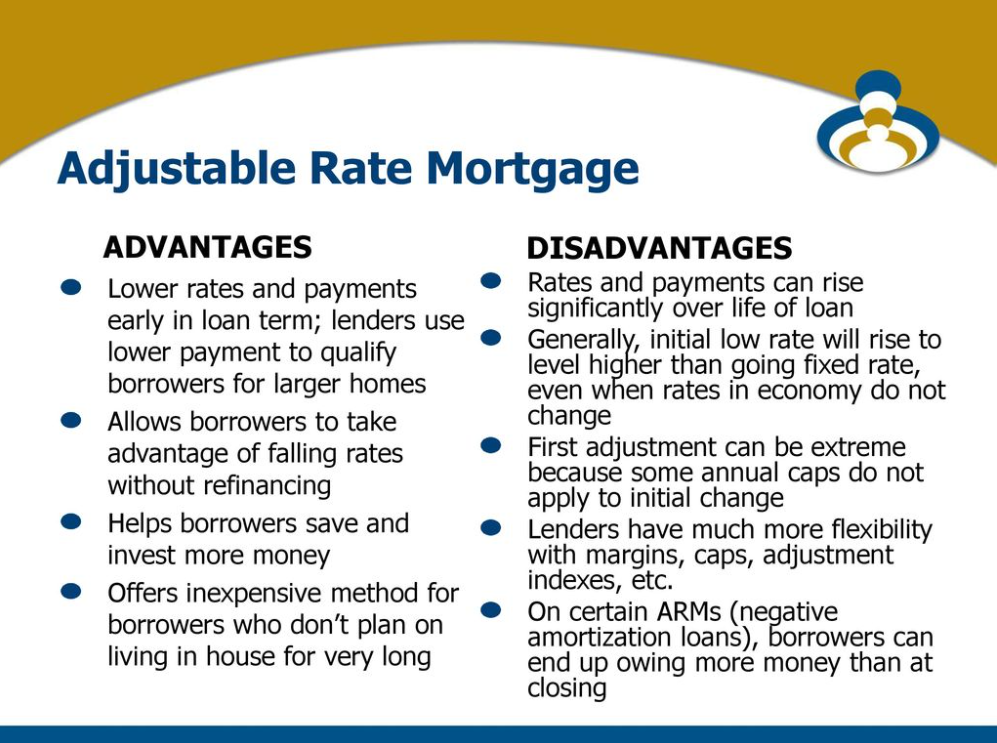

To know if an ARM is a right fit for you, here are its pros and cons:

Adjustable-rate mortgages are risky, but as interest rates rise, more homebuyers are starting to consider them. ARMs have lower initial interest rates than 30-year fixed-rate mortgages, but the rate will change after a set period. Borrowers must then pay the fixed rate when their lock period expires, which can be risky if interest rates are rising at the time.

If you would like to know whether the ARMs or Fixed Mortgage is for you, Heidi and I will be there for you to give you the knowledge to have an informed decision—with our experience, you can count on us. Call us!

It was fairly clear that the table had been set for the last Federal Reserve meeting to result in a minimal rise in mortgage interest rates. Their Fed Funds rate directly influences the mortgage interest rates that banks observe. Since Sebastopol real estate activity can be spurred or dampened by the monthly payment amounts Sebastopol mortgage lenders offer applicants, this national story has meaningful local repercussions.

It was fairly clear that the table had been set for the last Federal Reserve meeting to result in a minimal rise in mortgage interest rates. Their Fed Funds rate directly influences the mortgage interest rates that banks observe. Since Sebastopol real estate activity can be spurred or dampened by the monthly payment amounts Sebastopol mortgage lenders offer applicants, this national story has meaningful local repercussions.