When purchasing a house, having a good credit score is vital. A credit score is a number that represents how likely you are to repay your debts and shows your creditworthiness to lenders.

A higher credit score typically results in lower interest rates and better loan terms, while a lower score may lead to higher interest rates or loan rejection.

What credit score do you need to buy a house?

The credit score needed to buy a home can differ based on the type of mortgage and the lender’s requirements.

Generally, conventional mortgages may require a minimum FICO score of 620. However, FHA (Federal Housing Administration) loans may accept lower credit scores starting at 580, which is popular among first-time homebuyers.

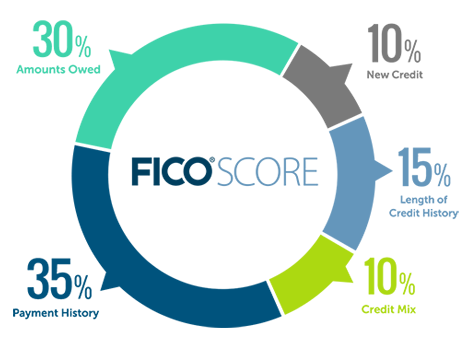

What are the factors that affect your credit score?

It’s common for lenders to look at your FICO scores to meet loan qualifications for Fannie Mae, Freddie Mac, VA, FHA, and USDA.

How FICO scores are calculated:

- Your payment history: A timely credit card payment history positively impacts your credit score. Bankruptcy, liens, and collections may also affect it.

- How much do you owe, and where?: If you owe a significant amount of money in multiple accounts, it may indicate that you are overextended. However, dividing debt among several accounts can help you avoid the maximum on any credit line.

- Your credit history’s length: The longer an account has been open, the better.

- How much new credit do you have?: New credit cards, instalment plans, or other forms of credit carry a higher risk, even if paid promptly.

- Your credit mix: It’s ideal to have a mix of credit types, including instalment loans, credit cards, and a mortgage.

What is a good credit score to buy a house?

720 or higher is considered good. Borrowers with credit scores of 800 or higher are likely to qualify for the best mortgage rates and terms available.

|

FICO credit score range |

|

|

Below 580 |

Poor |

|

580-669 |

Fair |

| 670-739 |

Good |

| 740-799 |

Very good |

| 800 and above |

Exceptional |

When purchasing a house with a partner

Lenders typically use the lower of the two borrowers’ middle credit scores to determine loan eligibility and interest rates.

Therefore, both partners should maintain good credit and work together to improve their credit scores before applying for a mortgage.

How to improve your credit score

- Check your credit report: Download one free credit report annually at annualcreditreport.com. Review for errors and correct any discrepancies immediately.

- Pay down credit card bills: Pay all your bills on time to demonstrate responsible financial behaviour.

- Don’t charge your credit card to the max: Aim to keep your credit card balances below 30% of your available credit limit. Using a lot of your available credit may lower your credit score.

- Don’t open new credit card accounts: Opening new credit accounts within a short period can signal financial instability to lenders, and having too much credit can lower your credit score.

- Wait 12 months after credit difficulties to apply for a mortgage: You’re penalised less severely for problems after a year.

- Shop for mortgage rates once: Too many credit applications can lower your score. However, multiple inquiries about your credit score from the same type of lender are counted as one if submitted over a short period.

Achieving homeownership is an exciting journey, but it’s important to understand your credit score’s role in making that dream a reality. Start taking proactive steps to improve your creditworthiness today.

Finally, we hope you found the information helpful. Please don’t hesitate to reach out if you have any questions or want to learn more. We are always happy to provide assistance and support.

There is a growing appreciation for handmade and artisanal elements in home design, as they contribute to the character of a home and create a space that reflects individual tastes.

There is a growing appreciation for handmade and artisanal elements in home design, as they contribute to the character of a home and create a space that reflects individual tastes.

Unlike traditional furniture with straight lines and rigid angles, organic-shaped furniture embraces curves, flowing lines, and irregular contours reminiscent of natural elements.

Unlike traditional furniture with straight lines and rigid angles, organic-shaped furniture embraces curves, flowing lines, and irregular contours reminiscent of natural elements.