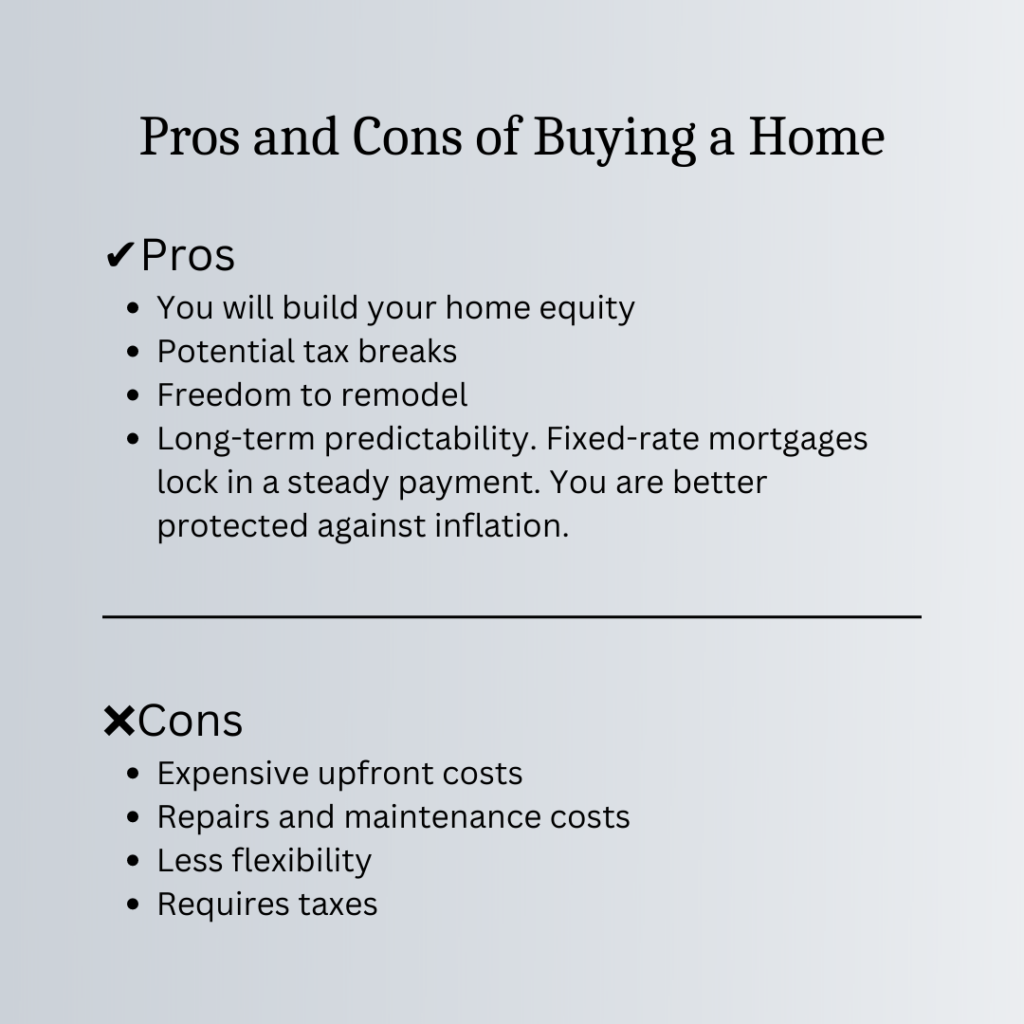

Which is better? Should you rent or buy a home? Because it requires less capital, renting is frequently perceived as less expensive than purchasing a home. Buying a home, on the other hand, is an investment that increases your equity. Aside from these obvious factors, there are others to consider. To assist you in deciding whether to rent or buy, we have listed the pros and cons of each option in this article.

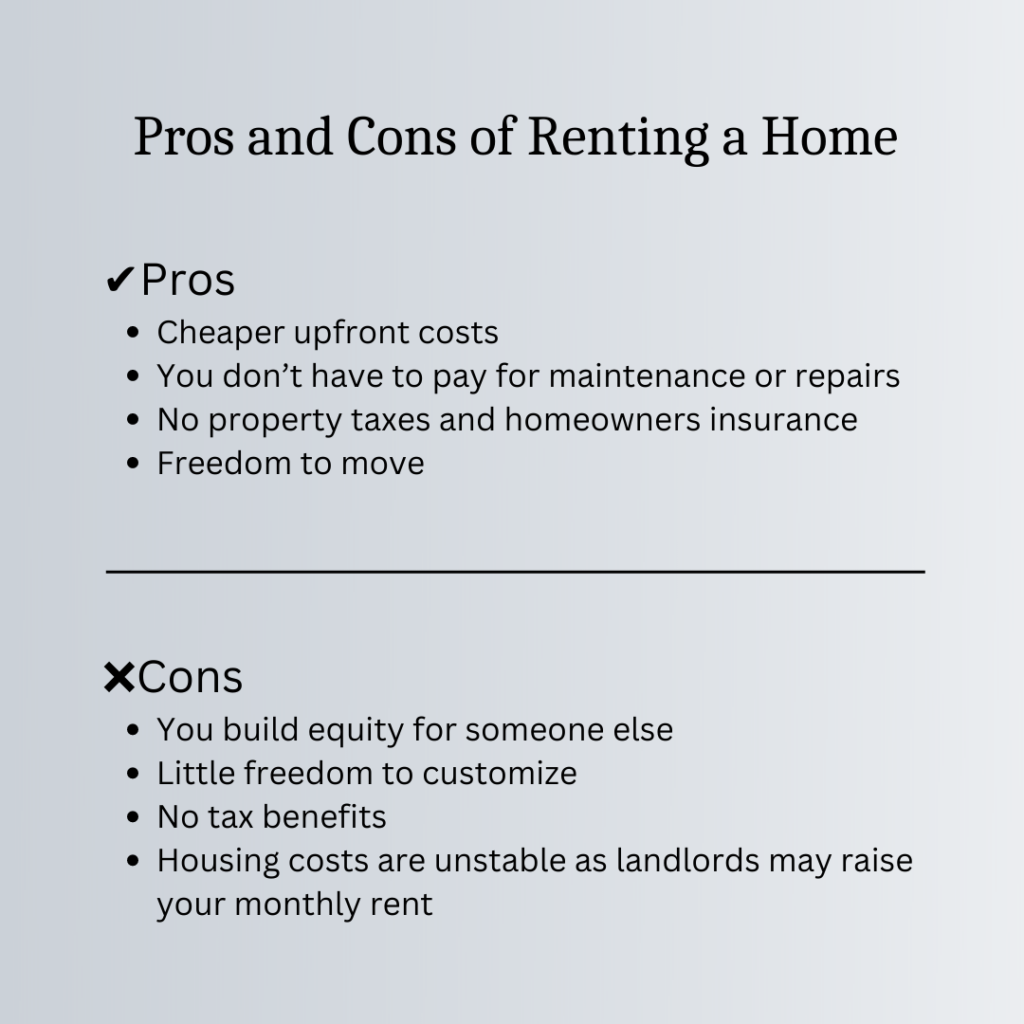

Deciding between renting or buying a home depends on your lifestyle and financial situation. Do you intend to temporarily live in the area, maintain flexibility and mobility, or save money for a down payment? Renting might be the ideal decision for you. At least for the time being.

Alternatively, if you want to build investment equity over time while also having the stability and freedom to change your living space, now is the best time to buy a home.

Furthermore, in most cases, purchasing a home may save you money. Because the interest on your home mortgage is tax deductible, you will save money on taxes. If you rent, your landlord gets the break. Also, the sooner you buy a home, the sooner you can begin building equity in an investment that you can use for retirement or other investment plans. Why pay the landlord’s mortgage when you can pay your own?

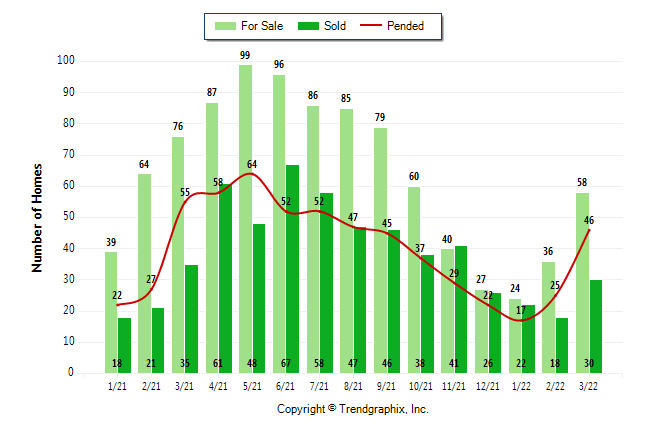

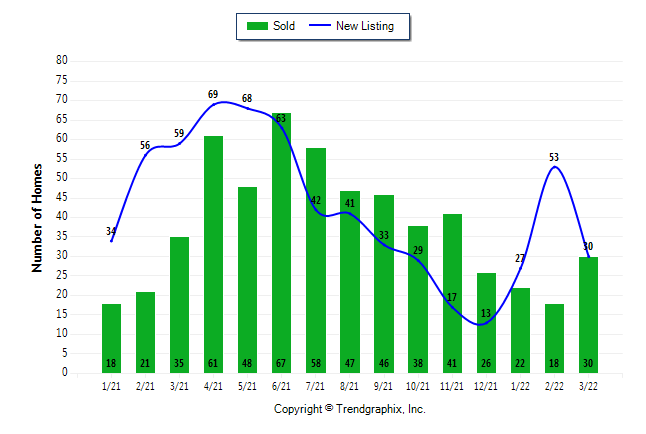

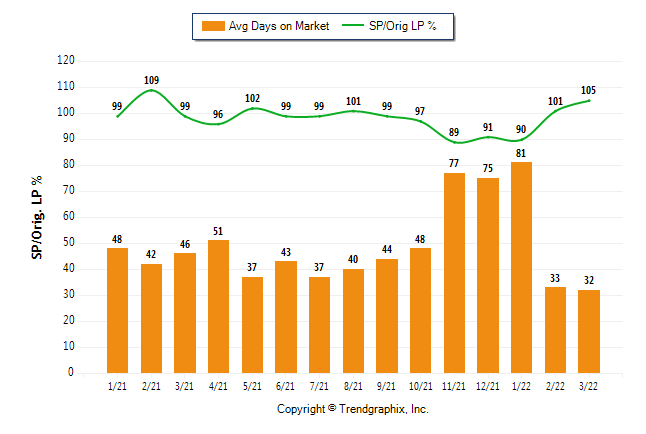

Finally, you would want to evaluate the real estate market. Heidi and I are very knowledgeable about current real estate trends and offer our clients exceptional expertise in assessing and securing an upcoming purchase in the current market. If you have a dream home that you can’t wait to build or are still not sure whether renting or buying is the best option for you, contact us and let us help you with our professional advice.

The green shade is a very soothing color that has a subtle tone but a strong appeal. That will give your kitchen a relaxing look.

The green shade is a very soothing color that has a subtle tone but a strong appeal. That will give your kitchen a relaxing look. A double kitchen island typically serves two distinct functions. They are typically parallel, but they can also be side by side or configured in any way that you would like. Double kitchen islands separate prep and dining/work areas, breaking up the monotony of the layout and adding much-needed interest in a large open plan space. They’re also one of those kitchen ideas that can work in smaller spaces.

A double kitchen island typically serves two distinct functions. They are typically parallel, but they can also be side by side or configured in any way that you would like. Double kitchen islands separate prep and dining/work areas, breaking up the monotony of the layout and adding much-needed interest in a large open plan space. They’re also one of those kitchen ideas that can work in smaller spaces.